What is Multifamily Data? Understanding Its Impact on Suppliers

For multifamily suppliers, multifamily data is a crucial component that can significantly shape decisions and strategies. Understanding its nuances is extremely important to better understand the current state of the market and how one’s business can adjust accordingly. But what is multifamily data?

Multifamily data refers to information related to properties that accommodate several households under one roof. This data encompasses various aspects of such properties, including but not limited to their physical attributes, financial performance, tenant demographics, and management details.

There are several types of multifamily data that one can obtain from data providers, and some examples include:

- Occupancy rates: This represents the percentage of occupied units in a property at any given time. It’s a vital indicator of demand and profitability in the multifamily sector. For instance, research by CBRE showed that the multifamily vacancy rate rose slightly to 5.0%, with a surge in net absorption, which reached 70,200 units. Research from SMART Apartment Data on national occupancy levels across various U.S. states also suggests high occupancy rates throughout the year, a key indicator of robust demand in multifamily housing

- Rental trends: This includes data on rental prices, growth rates, and yield trends. For instance, research shows that Houston’s multifamily market experienced a modest 1.0% increase in rent from the previous quarter and a more significant 4% rise year-over-year. This steady growth in rents indicates an underlying strength in the market.

- Demographic data: Understanding the demographic profile of tenants, such as age, income, family size, and preferences, is crucial for suppliers. This information helps tailor services and products to meet the specific needs of the resident population.

Depending on who seeks multifamily data, some types may be more valuable than others. For instance, a supplier would be more interested in multifamily data such as:

- Properties in the pipeline: Suppliers should focus on detailed insights into upcoming projects in the multifamily sector. This includes information on planned developments, anticipated timelines for groundbreaking and completion, and potential market impacts. Understanding these aspects helps suppliers align their services and products to meet the future demands of these new properties.

- Multifamily management and ownership changes: Tracking shifts in management and ownership of multifamily properties is crucial. This data encompasses transitions in property management companies, ownership entity changes, and any management hierarchy restructuring. Keeping abreast of these changes allows suppliers to adapt their approach, maintain relationships, and identify new opportunities for collaboration.

- New constructions and renovations: Detailed updates on new construction projects and major renovation undertakings in the multifamily sphere are indispensable. This includes specifics about the scale of projects, design, and architectural trends being employed, and the integration of new technologies or sustainable practices. Suppliers can use this information to tailor their offerings, ensuring they align with contemporary construction standards and client preferences.

- Onsite and personnel changes: Keeping track of personnel changes, particularly those in key decision-making positions at multifamily properties, is vital. This data should cover appointments of new property managers, maintenance team changes, and onsite administrative staff shifts. Understanding these dynamics helps suppliers build and maintain strong professional relationships, ensure service provision continuity, and adjust strategies to align with the new personnel’s preferences and operational styles.

Understanding this data is pivotal for suppliers, as it aids in making informed decisions, aligning supply with demand, and ultimately, contributing to the growth and sustainability of the multifamily sector.

One should note that there are multiple sources through which one can obtain multifamily data. Public agencies like the U.S. Census Bureau and the Department of Housing and Urban Development (HUD) provide comprehensive data on housing trends, demographics, and economic indicators relevant to the multifamily sector.

However, for detailed, customized, reliable, and actionable information, private multifamily data providers such as SMART Apartment Data would be best for suppliers.

All You Need To Know About Multifamily Housing Trends

Suppliers in the real estate market are diverse, ranging from construction material vendors to interior furnishing businesses, technology service providers, and even utility companies. Each plays a unique role in maintaining and enhancing multifamily properties. But for these suppliers to effectively target potential clients with their services, they need to understand multifamily housing trends.

This section of the article will briefly touch on some of these trends that suppliers can learn about and adapt to via a reliable multifamily data provider. These trends include:

1. The oversupply challenge

A pivotal concern in today’s multifamily market is the trend of supply outstripping demand. In recent years, developers, eager to capitalize on the flourishing multifamily sector, have overshot the long-term demand for apartment living. This has led to an oversaturated market, manifesting in reduced cap rates, escalated operating expenses, and diminished profits. Fortunately for investors and owners, recent research shows that multifamily cap rates have gradually increased, expanding 44 basis points from 4.63% to 5.07%.

2. Supply-demand dynamics

The National Apartment Association notes that the supply of new units has surpassed absorption rates for four quarters. This imbalance has caused the national vacancy rate to increase significantly, raising red flags about the market’s future trajectory.

3. Pipeline and submarket variations

The national supply pipeline is brimming, with reports showing over 1 million multifamily rental units in development. Urban areas, in particular, have seen a surge in inventory, while suburban markets have managed to maintain a more balanced supply-demand dynamic. However, the softening of demand coupled with the influx of new units is causing concern about potential oversupply in various regions.

4. Multifamily rent trends

As we previously mentioned, the average asking rent in the U.S. witnessed a nominal increase, but the picture varies across markets. Some areas are struggling with surplus supply, dampening the potential for rent increases. Remarkably, San Francisco stands out as a unique case, with reports showing it had the most significant rent reduction in the country.

5. The Sun Belt phenomenon

Sunbelt markets, once booming, are now experiencing a notable decline in rental rates. Cities like Las Vegas and Phoenix, which previously enjoyed high rent growth, are now facing negative growth trends. This shift is attributed to the looming risk of recession and the oversupply conditions prevalent in these markets.

6. Evolving tenant preferences and market trends

The multifamily market is also witnessing a shift in tenant preferences. Today’s renters seek more than just a place to live; they desire a complete living experience with amenities like fitness centers, co-working spaces, and smart home technologies. Moreover, sustainability and green initiatives are becoming increasingly important to tenants. Multifamily suppliers who can adapt to these changing needs are likely to thrive.

All the above trends show that the multifamily real estate market is complex but navigable with the right multifamily data provider. While challenges such as oversupply and shifting tenant preferences exist, opportunities remain for suppliers who are well-prepared and strategic in their marketing approach.

Reach out to us to unlock the most comprehensive source of multifamily data and elevate your business insights.

How Suppliers Can Leverage Multifamily Housing Market Data To Adapt to Trends

In the previous section, we looked at some current multifamily housing market trends and how they could impact suppliers. But what is a supplier to do, assuming they have a reliable multifamily data provider and have identified certain trends in the market? Let’s use the previously mentioned trends to provide actionable advice:

● Navigating the oversupply challenge: This trend, where the supply of multifamily units exceeds demand, has significant implications for suppliers. It necessitates a strategic approach to inventory management and market targeting. Suppliers must be agile, aligning their offerings with the current market conditions. For instance, in oversupplied markets, suppliers might leverage multifamily housing data to focus on renovation and upgrade services instead of new construction materials.

● Adapting to supply-demand dynamics: With the supply of new units surpassing absorption rates, suppliers must understand the nuanced supply-demand dynamics in different regions. This knowledge enables them to tailor their approach to each market. For example, in areas with high vacancy rates, suppliers might offer more competitive pricing or innovative products to attract property owners looking to enhance their property’s appeal.

● Responding to pipeline and submarket variations: Over 1 million multifamily rental units are in development, predominantly in urban areas. Suppliers should closely monitor these multifamily housing trends, identifying potential opportunities in these burgeoning markets. However, it’s equally important to recognize the potential risks of oversupply in these regions and diversify their focus to include suburban markets, where the supply-demand balance may be more stable.

● Understanding multifamily rent trends: The variance in rent trends across different multifamily real estate markets is critical for suppliers. In areas with stagnant or decreasing rents, like San Francisco, suppliers might need to adjust their strategies by offering more cost-effective solutions or focusing on markets with healthier rent growth.

● The Sun Belt phenomenon: The changing dynamics in Sun Belt markets, once characterized by booming rental rates but now facing a downturn, underscores the need for suppliers to be adaptable. Suppliers who previously benefited from the growth in these markets must now reassess their strategies, possibly shifting their focus to other emerging markets or adapting their product lines to align with current market conditions.

● Catering to evolving tenant preferences: Finally, the shift in tenant preferences towards amenities and sustainable living presents a significant opportunity for suppliers. Those who align their offerings with these trends—whether by providing eco-friendly materials, smart home technology, or products catering to lifestyle amenities like fitness centers and co-working spaces—will find themselves well-positioned in the current multifamily market.

One should note that all of the above cannot be achieved without a reliable multifamily data provider: a provider such as SMART Apartment Data.

Why Savvy Suppliers Choose SMART Apartment Data as Their Multifamily Data Provider

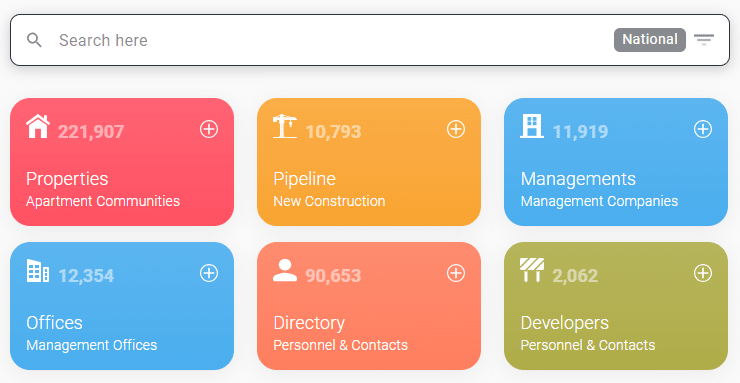

SMART Apartment Data is recognized for its expansive multifamily data and accurate analytics, providing the most extensive national datasets trusted by over 10,000 industry professionals.

The Supplier Solution spans all 50 states, covering 180 markets and offering current and historical data for properties, management companies, developers, and more. This extensive coverage ensures suppliers access the most relevant and comprehensive market insights.

Multifamily data provided by Smart Apartment Data is meticulously gathered by professional, highly trained researchers who obtain information directly from on-site staff. This method, coupled with extensive quality audits, ensures unrivaled accuracy in the data. For suppliers, this means reliable and trustworthy insights for informed decision-making.

As a supplier, you gain access to detailed contact information across ten departments and decision-making roles within every management company in the apartment industry. This enables you to target your marketing efforts more effectively, reaching the right decision-makers with the right offerings.

If you are looking for that competitive data advantage, choose SMART Apartment Data.

Explore the latest trends in multifamily data and analytics by reading our blog, or simply get started with our tailored data solutions for your business.

Ready to close more deals and exceed sales goals?

Meet with a data expert and discover how Smart connects companies like yours with industry leaders.

Related articles

Proud members of